Q2 2021 quarterly valuation update for the energy and infrastructure sector

Q2 2021 quarterly valuation update for the energy and infrastructure sector

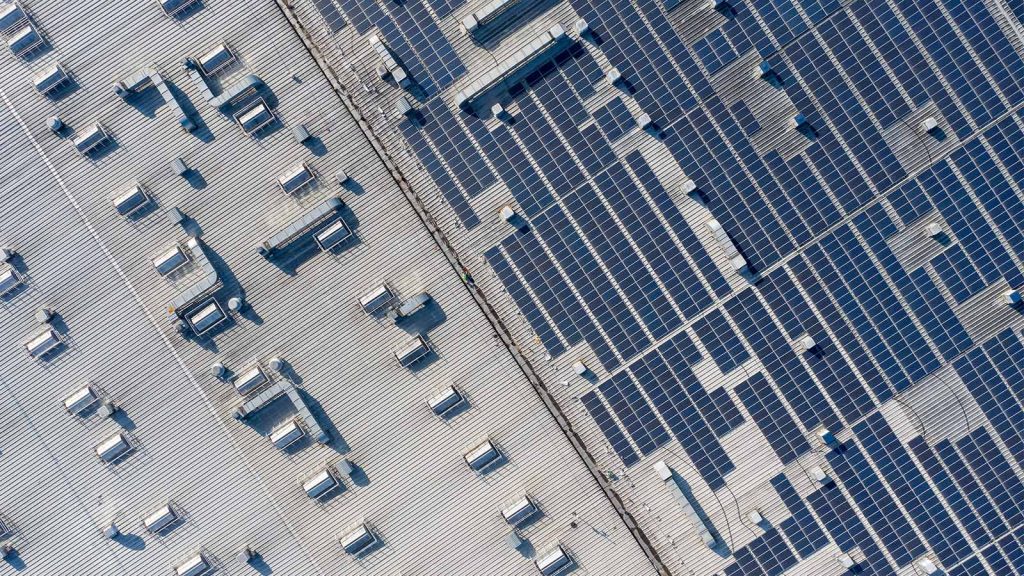

The number of listed and unlisted funds established specifically to invest in and manage real assets across the energy and infrastructure sector is growing, as infrastructure is becoming an increasingly mature asset class. To provide a fresh perspective on trends in debt and equity metrics, Mazars releases a ‘quarterly valuation update’ for the global energy and infrastructure sector.

This quarter we continue to explore trends in debt and equity metrics relying primarily on publicly available information. In addition, we have included a spotlight on digital infrastructure funds, looking at some emerging valuation trends from the two digital infrastructure funds that have recently been listed on the London Stock Exchange (Cordiant Digital Infrastructure and Digital 9 Infrastructure).

Three trends from Q2 2021

- The cost of debt for infrastructure and energy assets remains low despite the increases to Government bond yields seen in Q1, and asset managers have successfully refinanced assets including those with volume risk that were most impacted by Covid-19

- The quarter has seen further evidence of increasing valuations across the infrastructure space, with reports of lower discount rates in some sub-sectors and real-world improvements to cashflow forecasts for assets with demand-based revenues

- Large-scale capital market fundraising in the digital infrastructure sector, with two new listed funds launched in the UK, is a sign of a growing investment opportunity and is likely to presage more transactional activity and increasing competition for assets

Download our quarterly valuation update for Q2 2021