Q1 2021 quarterly valuation update for the energy and infrastructure sector

Q1 2021 quarterly valuation update for the energy and infrastructure sector

Infrastructure is an increasingly mature asset class, with a growing number of listed and unlisted funds established specifically to invest in and manage real assets across the energy and infrastructure sectors. To provide a fresh perspective on valuation metrics, Mazars has launched the ‘quarterly valuation update’ for the global energy and infrastructure sectors, covering both debt and equity metrics.

Focusing on some of the main publicly available valuation trends in the sector, we have created two global indices that focus on listed funds as part of this update:

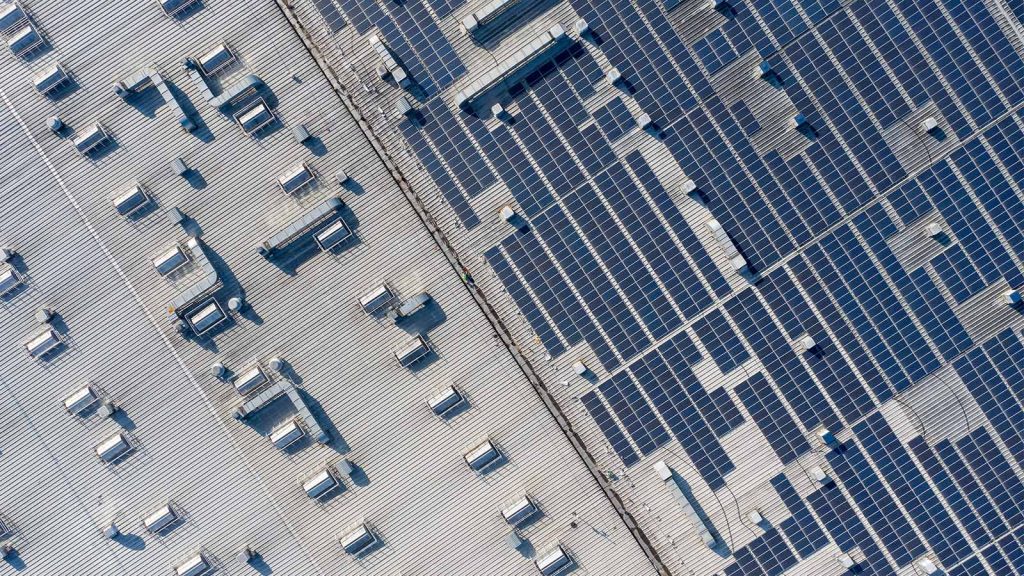

- An infrastructure funds index, currently including 11 funds with activities across 15 countries

- An renewable energy funds index, currently including 15 funds with activities across 12 countries

This first update highlights three trends from Q1 2021:

- Government bond yields were rising around the world. To some extent, this was feeding into investment grade bond pricing; however, to put this into perspective, the cost of debt at the end of Q1 2021 was similar to pre-Covid levels.

- There were signs of rising asset valuations across the infrastructure sector, driven partly by reduced discount rates in the lowest risk asset classes and partly by re-forecasting of cashflows for assets with volume risk, linked to broader expectations of economic recovery.

- In the renewable energy sector, funds have been signalling higher asset valuations for some time. But share price reductions in Q1 2021, combined with reduced premia to NAV, may be suggesting the market was no longer seeing significant valuation upside – the potential for short term recovery in power prices didn’t change that.

We hope that this update provides an interesting view on valuation metrics in this space and, in doing so, adds to the knowledge base across the sector.

Download our quarterly valuation update for Q1 2021