Energy transactions | 30 March 2020

It has been some few weeks. I am writing this from home, connected to team members and clients through technology but otherwise working in isolation, and this experience will be familiar to nearly all of our clients around the world.

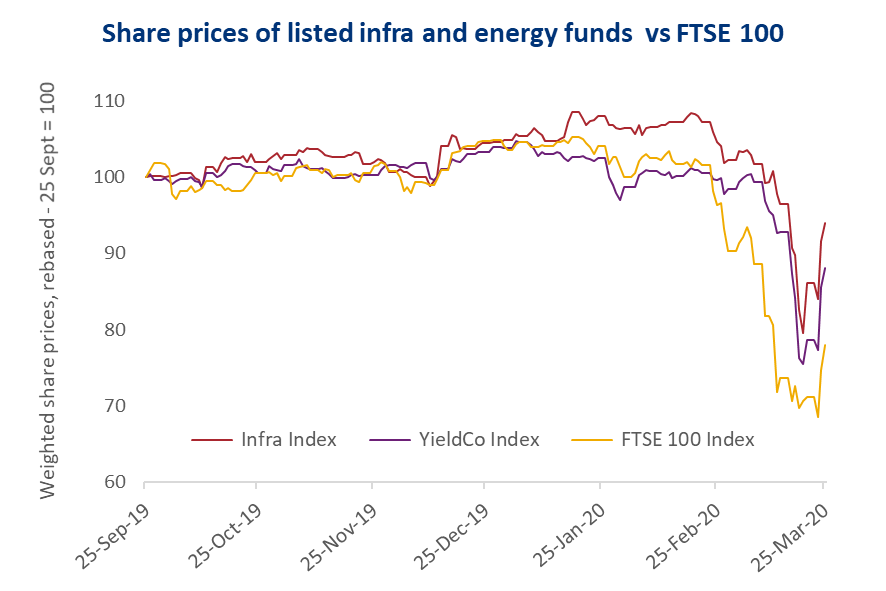

As well as its direct impact on people who have contracted the disease, Covid-19 has also already enormous social and economic impacts. But what about in the infrastructure and energy space? Even a cursory glance at the equity markets would suggest that the hit has been enormous. Listed yieldcos and infrastructure funds have seen share prices fall by anything between 10% and 30% since their peaks, with significant volatility. This impact may have been less than the wider market (see the graph below). But it still represents a material devaluation of an entire sector that is based around a value proposition of being mostly non-cyclical, built on safe and steady long-term returns.

Having talked at length to dozens of clients around the world since the crisis began, however, it is clear to us that the real-world impacts on portfolios and valuations are more nuanced than this, and the valuation of underlying assets may be less affected than the equity markets are suggesting.

Impacts on existing portfolios

Covid-19 is undoubtedly having some real-world impacts on assets – but affecting some sectors much more than others.

Here are some examples of common impacts:

- Impacts on demand / volume. For assets such as toll roads and airports, the lockdowns and reduced travelling can have very direct impacts on revenue streams which are linked to traffic or passenger volumes. However, these impacts are not uniform. Revenue structures for these projects often have some protections built in, including guaranteed return mechanisms or floor price arrangements. In some countries where procurements took place before the 2008-09 economic crisis, volumes may never have recovered above these floor levels, and so a further reduction of demand is not actually affecting revenue streams.

- Impacts on construction processes. Disruptions to supply chains and to the ability of construction workers to physically get to sites have inevitably led to delays.

- Impacts from forecast macro-economic drivers. Assets which benefit from inflated revenue streams may find that inflation is lower than anticipated in the short and medium term. Exchange rate volatility may have impacted some projects to the extent unhedged. Power prices have moved materially lower in the short term – and will also reduce in the longer term. More of which below.

- Assets impacted operationally. Most assets are still able to function as normal from an operational perspective. Across the renewable energy sector, for instance, even if maintenance and cleaning activities are reduced, solar PV and onshore wind projects are mostly operated remotely and will continue generating electricity without the need for a physical operator. Anaerobic digestion and biomass may be different, requiring more physical presence as well as a continuous physical supply of feedstock. They are therefore taking up more asset owner attention.

- Assets mostly unaffected. Availability-based assets have had to adapt operationally to the challenges of Covid-19, with very different implications for instance if comparing schools and hospitals. But from a revenue and cashflow perspective, these assets are basically not impacted by Covid-19. The same would apply to many regulated assets, as well as power assets with contracted (rather than merchant) revenues.

The above list isn’t exhaustive. But there are some principles that come out of it. Firstly, for a diversified infrastructure or energy fund, there are likely to be many assets for which forecast cashflows are mostly unchanged. Secondly, even where there have been significant impacts, these are mostly likely to be temporary in nature. The longer-term picture – and most infrastructure assets are 25 year or longer investments – may be relatively unaffected.

Deal flow – how have transaction volumes been impacted?

The position in terms of deal flow and

appetite for doing deals across the sector is also not straightforward.

On the one hand, we have seen a lot of

deals close over the past few weeks. According to Inframation, 60

infrastructure and energy transactions have closed around the world since 1

March – and we know of others not included in this list. Perhaps more

surprisingly, 57 transactions have been launched in this period, including 24

in the renewable energy space. These span more than 20 countries and is in line

with the monthly average for the previous 6 months.

These figures contrast with just 20 deals being

cancelled, nearly all in the US. Again, this number is not that different from

the monthly average in the previous 6 months.

All this suggests sentiment is holding up for now, and certainly the weight of feedback from our client base is that there are funds to deploy, a desire to keep doing deals and no dramatic change of approach or strategy.

There are some headwinds however. Lenders are still looking to lend, but not necessarily to underwrite, and there is reduced risk appetite in some cases. Listed funds may find that they become constrained if their ability to tap up the equity markets is reduced and lower valuations mean they push against their gearing limits.

And in the renewable energy sector, an emerging challenge to deal flow – at least for those projects relying on merchant power revenues – is the prospect of material reductions to power price forecasts. This is not just driven by the short-term drop in demand for power linked to Covid-19. There is a longer-term structural shift being forecast too. Inevitably this will make it more difficult for potential buyers of projects to meet seller / developer expectations – at least until those expectations start to shift – and it will also reduce debt capacity to these projects.

Reflections on how Valuations will be impacted

Some observations on project valuations to finish with:

- We are not yet seeing wholesale changes to discount rates, either in the context of a transaction process or in terms of funds valuing their own portfolios.

- A small minority of funds are looking at putting a risk premium on the discount rates used to value their assets for reporting purposes.

- A much bigger priority across our clients is to look at reforecasting cashflows to reflect the current expectations for individual assets. This process may take a few months to play out, but at the end of this we may start to see some NAV reductions for some funds, linked to the types of impacts noted above.

- We would expect this to feed into transactional pricing too, with perhaps a process of replacing ‘stretch’ assumptions with more prudent assumptions.

- If debt capacity is reduced, then we can expect to see spreads increase – perhaps not dramatically, but enough to increase the required unlevered equity returns for new deals where funds are relying on subsequent leverage to achieve a target levered return.

Therefore, we would expect to see some modest revaluation of assets occurring over the next few months and the pricing of new deals potentially to be less bullish. But this will not be across the board and will mostly reflect asset-specific impacts rather than an instant reaction to Covid-19 related market movements.

Response from selected listed infrastructure and energy investors

A. HICL

Expecting financial impact from COVID-19 on the c. 20% of its portfolio that is demand-based, although too early to quantify this. The projects are well-placed in relation to their near-term debt service obligations and the remainder of the portfolio is expected to be largely unaffected. (Source)

B. INPP

No material impact on cashflows across the portfolio to date and projects well-protected. However, notes a range of contingent risks stemming from the COVID-19 pandemic such as staff shortages, supply chain breakdowns and similar risks. (Source)

C. JLEN

No material long-term impact from COVID-19 on ability to meet investment objectives expected; however, anticipates further short-term reduction in power prices to have some impact on overall revenues. (Source)

D. GCP Infrastructure

Investments well-placed to weather uncertainty driven by COVID-19 over the long term. Potential short-term impacts from reduced availability of personnel responsible for operating, managing or maintaining assets, or reduced availability of spare parts, as well as from short‐term reductions to electricity prices. (Source)

E. 3i Infrastructure

Limited operational impact to date, although TCR (its airport ground handling equipment business) is affected by sharp reductions in air travel. Impacts on portfolio valuation will be assessed on 31 March, and will seek to take account of individual cashflow effects on portfolio companies as well as broader market pricing considerations. (Source)

F. The Unite Group Plc:

Short-term impact from agreeing to cancel student rents. Longer term impacts expected to be limited, and latest reservations for 2020-21 are in line with previous years. (Source)